How should you set up Attio for a VC fund?

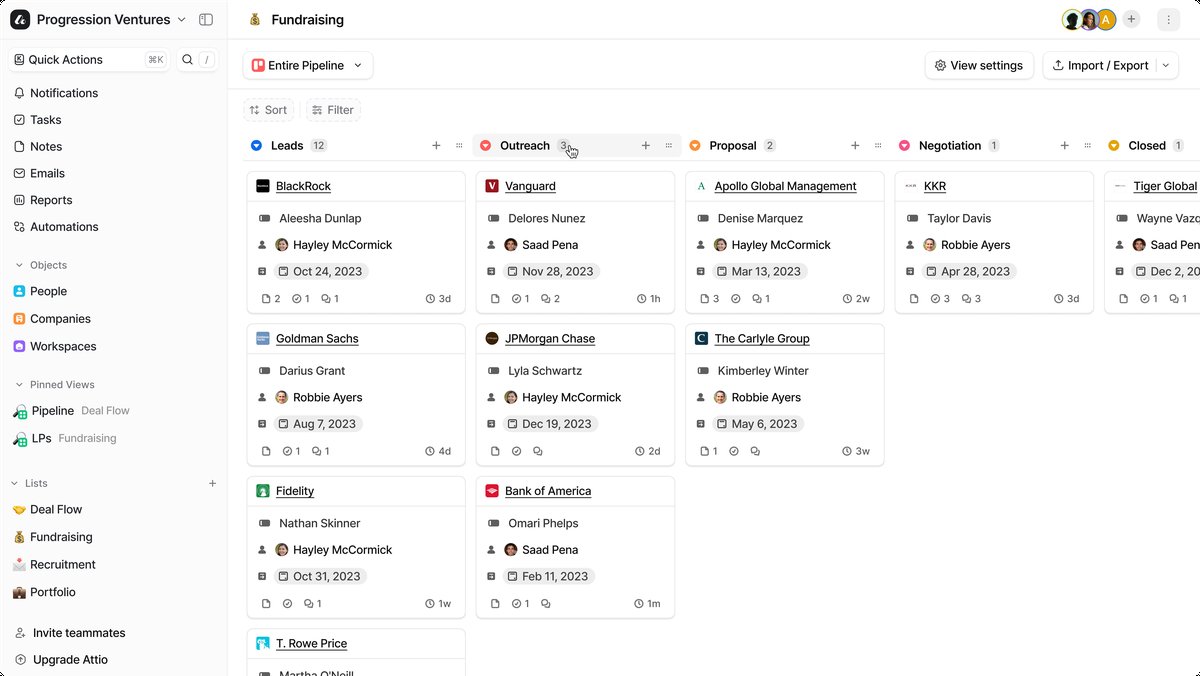

Start with a custom Deals object. This is the backbone of your workspace. Every investment opportunity gets a record here, with a status attribute acting as your pipeline. Stages like "Sourced → First Meeting → Due Diligence → Term Sheet → Closed" give you a clear view of where everything stands. Add a currency attribute for check size, and you immediately get filtering, sorting, and reporting on deal values across the pipeline.

A VC workspace in Attio centers on a custom Deals object linked to Companies and People.

A VC workspace in Attio centers on a custom Deals object linked to Companies and People.

The key architectural decision is how you connect Deals to the rest of your data. Use relationship attributes to link each Deal record to a Company and to the relevant People (founders, board members, co-investors). This means you're not duplicating contact information. You're building a graph of relationships that Attio keeps in sync across your workspace.

For portfolio tracking, create a list filtered to closed deals. This gives you a portfolio view that pulls from the same underlying data as your active pipeline, just sliced differently. You can add list-specific attributes here for things like board seat status or reporting cadence without cluttering your deal flow view.

If you're tracking LPs and fund operations, a custom Funds object works well. Link it to a separate LPs object (or just use People with a tag or status attribute if your LP base is small). Currency attributes on Fund records handle committed capital and deployed amounts. Most early-stage funds don't need this level of structure on day one, but Attio makes it straightforward to add later without reworking everything.

A few things I always set up for VC clients: an automation that creates a task when a deal hits Due Diligence, a filtered view per partner showing only their sourced deals, and relationship attributes linking People across both the deal side and the LP side. That last one is where Attio's data model really pays off: when a founder from one portfolio company shows up as a reference for a new deal, you see that connection immediately.

Keep the workspace lean at the start. A Deals object with a pipeline, relationship attributes to Companies and People, and a couple of lists for active deals and portfolio. You can layer on complexity as the fund matures and your operational needs become clearer.